Anyone can flip a house… but not everyone has a house flipping business plan that will ensure their flip is profitable. Whether you’re interested in flipping on the side, trying to flip full time, or you want to use home flipping as a gateway into real estate investment, it would be very helpful to know what will allow you to claim the most return on your investment — plus, where to get the money to fund the deal in the first place.

House flipping is not just a real estate deal. House flipping is not just a renovation. House flipping is not just an investment.

It is all of the above and so much more. You may be strong in financing but lacking expertise in real estate and home renovation. Or maybe you’re strong in home renovation but lacking expertise in real estate and financial investment. Successful flipping dictates that you have a level of expertise in:

- Researching Opportunity

- Purchasing Real Estate

- Managing Finances

- Cost Effective Renovation

- Selling Real Estate

Again, anyone can show up and do these things, but only those who show up with a house flipping business plan that is built off of an expertise in all these areas will render the biggest profit (and avoid the biggest headaches).

The house flipping business plan shared below will be a valuable roadmap as it will provide structure for the deal (from start to finish) and clarify the business deal strategy as a whole.

When creating a business plan for house flipping, you must carefully consider various factors that can impact the success of your venture. For example:

- Examples of successful business plans

- Financial projections

- Marketing strategies and tactics

- Project timelines

- Construction costs

Buying a home to live in is a risk in and of itself. However, in the end it’s a home you’ll live in and time can mitigate mistakes. Buying a home for the expressed purpose of turning a profit means you have much less margin for error, thereby, compounding the potential risks. If buying a primary residence requires foresight and planning, flipping a home for profit requires an exponentially greater amount of both.

In the flipping business plan below we have put together a well-thought-out process for you to learn, adopt, and follow in order to increase your chances of a successful flip, which means, profits!

Other People Who Have Followed This Business Plan

This business plan for house flipping is not theory. It’s not conceptual. It is not just a collection of ‘good ideas’.

What you are about to learn is the cornerstone approach that has allowed everyday men and women, average Americans, to profit $35,000, $55,000, even $100,000 on their first flip.

If you’re looking for concrete evidence of a successful plan, you’re in the right place.

Who are these people? You can meet them, hear their stories, learn about their experiences, and discover just how much profit they were able to generate with their flips.

Blueprint Real Estate Guide to Growing Trends

You’re not blind — house flipping is a trend that has been trending upwards over the last couple decades.

Truthfully, flipping houses has always been a legitimate real estate play but with the advent of home flipping and home renovation television shows, it has gone from a real estate play for heavy investors to a gateway into generating wealth in real estate.

Even still, not everyone gets wealthy off of house flipping. Many people start off with deals that look promising but a lack of knowledge, experience, and expertise turns their dreams into a nightmare.

In the first quarter of 2022, one in ten properties for sale was solely targeted for house flipping. In the year following that number has doubled.

If you want to know why the trend has gone from little known real estate deal, to entertainment novelty, to mainstream real estate investment opportunity, all you need to do is dip your toe into learning about the market condition, competition, and individual business practices that have developed over the last decade.

Regardless of the current trends, one thing is true — real estate in any financial market can be incredibly lucrative and home flipping has proven to be the gateway deal into developing a strong real estate investment business.

Despite the growing trend, the market remains rich with opportunity and if you have a strong home flipping business plan you will purchase your property with a certain understanding of the market, a clear approach for the renovation process, and even possibly a mentor or flipping coach to help you navigate the ins and outs of the deal.

Real Estate Blueprint

The appeal of house-flipping as a blueprint for real estate investment comes from the potential for quick profits without long-term commitments. This is the phenomenon that reality TV shows have leaned into, leading anyone sitting on a couch at home watching a reality flipping show to think, “I could totally do that.”

Yes, you can! But can you do it for maximum profit? No. Not if you don’t have a proven plan to follow.

This is what makes a blueprint for flipping attractive. “If I had a proven plan that would tell me what to do, what to expect, and how to get the most for my money, I think I could pull this off.”

Now you’re thinking!

And you do need to be thinking this way because flipping houses carries certain risks.

The process, especially the first time, can be demanding, time-consuming, and emotionally draining. When you are working harder than you’ve ever worked, putting in more hours than you’ve ever put in, and the ‘sold’ sign seems to be further and further away than you initially planned, it becomes apparent that you got into something more than you bargained for.

We want to avoid that and to do that, we need to get back to, “the proven plan.” Not a 20 minute television show. Not a YouTube channel. A real, practical and tactical plan that works wherever it’s tried.

This is what separates successful flippers from those trying to implement a combination of mimicking what they’ve done in their own personal residence and what they’ve seen on tv.

The truth about HGTV is that ordinary people can purchase, fix, and sell their property for profit. That’s absolutely true. But notice, they are usually paired up with a show host who is coaching them and leading them through the process. And this is exactly what you need.

Before embarking on your first house flip, ask yourself the following questions:

- What is the average cost of flipping a home?

- What considerations should you I keep in mind before flipping my first house?

- How can I make money flipping houses without using my own money as the startup capital?

- Is the fix-and-flip real estate market really profitable?

- How much knowledge do I need in real estate and construction?

- Where can I find the best property deals to flip?

You don’t know what you don’t know. Perhaps you see some of these questions and think, “Well why would I need to know that?” This underscores just how important it is to know what you’re getting into before you get into it and what you’re going to do once you are in.

A game plan. A blueprint. A framework. A roadmap. Call it whatever you want… in the end you’ll make more money if you go in with a plan you know works as opposed to figuring it out as you go.

There are ten items essential to your business plan:

- Cost analysis of house flipping

- Assessing the worth of house flipping

- Timeframe for house flipping

- Emphasizing the importance of timeline

- Experience required for house flipping

- Strategies for finding house to flip

- Where to spend your $10k when flipping

- How to overcome financial obstacles

- Duration of the house flip (start to finish)

- Techniques for finding ideal flip properties

We are going to provide you with the blueprint. You’ll be grateful for every word. But consider going further with Home Flipping Workshop to assist you in structuring your plan effectively to your market and timeline. You’ll be happy you have a business plan that provides valuable insights and templates to enhance planning and execution.

Funding A House Flipping Deal

How much money will you need to flip your first house?

Truthfully it’s not so much about ‘how much money’ you will need and it’s more about where are you going to get the money to fund your flip.

You do not need and really should not use your own money as the bulk of your capital for the deal. You will need some money, several thousand dollars, but the majority of your funds should come from other people’s money (OPM).

Financing is often what scares people away from real estate.

Either 1) they look at their own finances and think, “I don’t have enough money to get into real estate,” or 2) they are just scared of losing what money they do have doing something that is ‘risky.’

Your first move, before you do anything, is to explore the financing options available to you outside of your own savings. This is how the big time real estate investors do their deals and it’s exactly what you should do, too.

Here are options that we focus on when working with students during Home Flipping Workshop.

- Hard Money Lenders

- Private Investors

- Crowdfunding

- Joint Ventures

- Real Estate Syndication

- Real Estate Investment Trusts (REITs)

- Seller Financing

- Personal Funds and Equity

- Institutional Lenders

Maybe you see some of these options and think, “That looks risky,” or, “That’s seems scary to think about.” And you’re right… without a plan, without a pathway it is risky and it is scary. But you’re not going into this willy nilly. You’re not going to try and flip a house with zero experience in real estate, finances, or construction.

You’re going to use a plan and your plan is going to be catered to your timeline… as such, you can look at each financing option and choose the option that gives you the greatest leverage.

Maybe you can afford a hard money lender because your timeline is short.

Maybe you have substantial equity in your home and can take out a loan (while it’s your equity, it’s the bank’s money).

Before you do anything you need to work out your funding.

Funding is a part of your overall finances and you need to be aware of all the costs that will go into your flip. There are obvious costs (purchase of the property, renovations, materials) and there are a lot of costs that you’d never even think of until you’re faced with the bill.

A part from the purchase price, you’ll need to take into account additional expenses including but not limited to:

- Loan costs

- Selling costs

- Carrying costs

- Insurance costs

- Renovation costs

All of these costs will add up and as you determine your budget you will need to keep all of these potential expenses in mind. This is where having financial expertise and real estate expertise comes in really handy. Bottom line, get these numbers right in the beginning and you’ll have a stronger idea of how much you will stand to make in the end.

While there is no one-size-fits-all formula to determine it all, partnering with a professional who has navigated this type of deal in the past will provide you with a stronger baseline. Whether you work with Home Flipping Workshop or you’ve already identified a party who will help you map out your these finances, the more prepared you are ahead of time, the stronger your leadership will be during the project, and the bigger profit you will stand to make.

As you identify potential properties you will be able to fill in your evaluation worksheet (and you can download our free real estate evaluator worksheet here) and the numbers will come into focus.

Know How Much Will Your Flip Stand To Profit

“Is house flipping worth the cost?” It depends.

It absolutely can be worth the cost of time, money, and effort.

“Is it worth it to you?”, is the correct question.

Why are you wanting to get into flipping? Are you trying to earn an extra $5,000 a month? Are you trying to pay off debt? Are you trying to replace a full time job?

Are you trying to take a dream vacation? Are you trying to move to your dream location? Are you trying to build a dream house?

No matter what your reason for flipping is it will absolutely not be worth it if you end up making only a fraction of what you hope to. You need to know before you put the deal together that when you’re finished you will make at least the amount needed to fulfill your reason for flipping.

That said, if you know how to spot the right deal with the right potential, yes, flipping can be absolutely worth it… and more than that, predictable.

Think about that… PREDICTABLE.

Having command over your finances before you get into the deal a way to determine if a flip will be worth it before you get into the middle of the deal.

We want your first flip to be incredibly profitable. But more than that, we want you to get through your second flip. Once you have flipped two homes you have, in effect, build a working knowledge of what it takes to succeed in real estate and you are now, in effect, ready to take on any type of real estate deal.

Home flipping is a gateway to real estate investment but it all starts with getting the finances straight.

Variable Costs of House Flipping

In your business plan, you need to account for the variable costs associated with house flipping. Here are some of the variables that can impact your costs:

- Property Acquisition: The cost of acquiring a property for flipping can vary widely based on location, market conditions, and property type.

- Renovation and Repairs: The extent of renovations and repairs needed to make the property market-ready can significantly impact costs.

- Labor and Contractors: The cost of labor and contractors can vary depending on the scope of work, location, and market conditions. Skilled tradespeople such as carpenters, electricians, plumbers, and painters will charge different rates, and these costs will contribute to the overall expenses.

- Materials and Supplies: The type and quality of materials and supplies used for renovations are crucial in costs. The prices of construction materials can fluctuate based on market conditions, availability, and the project’s specific requirements.

- Holding Costs: Flipping property involves carrying costs during the renovation and selling. These costs include property taxes, insurance, utilities, loan interest payments, and maintenance expenses. The longer the property remains unsold, the higher the holding costs.

- Financing: The method of funding used for the project will impact the costs. Interest rates, loan origination fees, and other financing charges can vary depending on the chosen financing option, such as traditional mortgages, hard money loans, or personal funds.

- Marketing and Selling: Marketing and selling costs can vary depending on the strategies employed. Expenses may include professional photography, staging, advertising, real estate agent commissions, and closing costs.

- Market Conditions: The overall state of the real estate market, including supply and demand dynamics, can influence costs associated with housing flipping. In a competitive market, property acquisition costs may be higher, while market trends may influence selling prices.

You’re no stranger to fluctuations in the market. Not just the real estate market but the economy altogether.

Consider the new homes that were sold in 2018 but weren’t set to be built until 2021. The cost of materials jumped so astronomically high that it made the housing prices that were agreed to in 2018 no longer viable and many people were unprepared for the true cost of their home when it was eventually built.

Your home flip won’t take 3 years but the example shows just how much things can change and we’re telling you this so you can build in the margin necessary.

The housing market is subject to fluctuations, and an investor could end up with a property that takes longer to sell than expected. Or you might possess a property that sells for less than the cost of renovations.

Do the research. Understand the market. Build in margin. Establish a timeline to keep you on time and on budget.

How Long Does It Take to Flip A House? Establishing Your Timeline

Staying on budget is largely determined by establishing and keeping a project timeline.

Not every home project will operate on the same timeline. Some jobs will take more time and some will take less. As you build your plan, one of the conversations you need to have with your coach or professional consultant will be, “What type of timeline can I afford?”

Some financing options will necessitate a shorter timeline.

Some materials needed for a job will necessitate a longer timeline.

So while we can’t give you an example timeline (to do so would not be responsible), having the conversation as you build your business plan is essential.

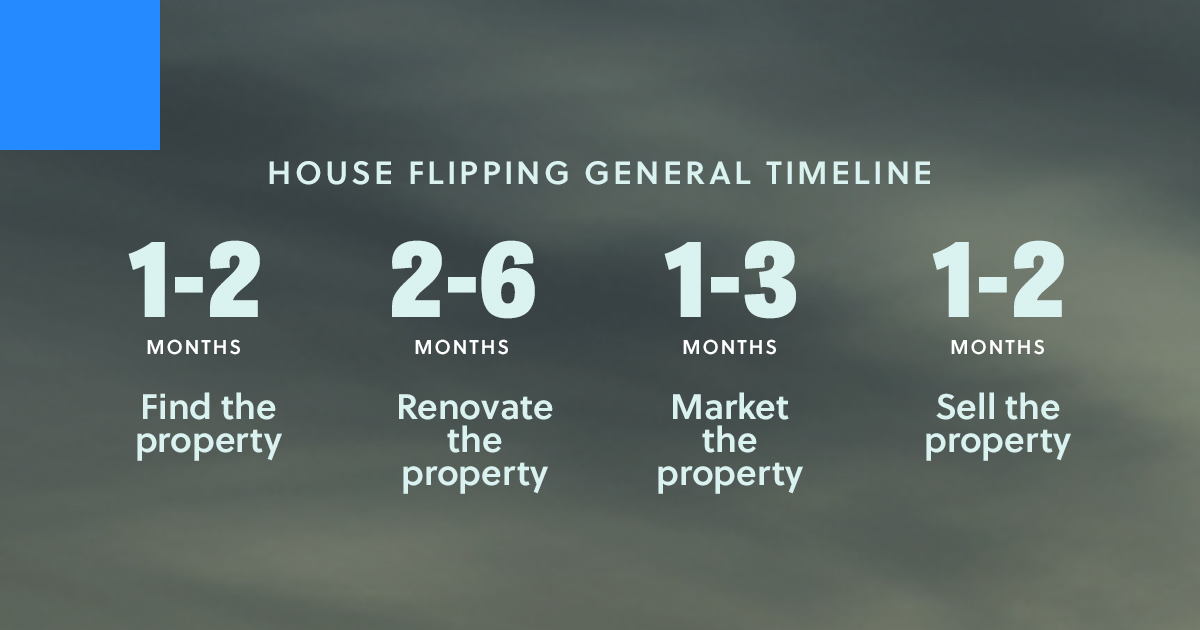

Glenn & Amber Schworm, Co-Founders of Home Flipping Workshop, have flipped over 1,100 homes and in doing so have generated over $100 million in revenue. With that much water under the bridge, they have provided some general guidelines for timelines. You can expect your timelines to fall within these parameters.

- 1 – 2 Months – To Find a Property

- 2 – 6 Months – To Renovate the Property

- 1 – 3 Months – To Market the Property

- 1 – 2 Months – To Sell the Property

Again, this is a very broad timeline that you can expect to operate off of. These are reasonable goals to set for each critical stage. For a beginner, completing a flip in one year is excellent. However, an experienced investor can flip a house in approximately 6-9 months.

If you have maintained any relationships over time you know how important communication is. Ordinary friendships, romantic relationships, and business partnerships all thrive on clear and precise communication. A project timeline provides the type of clear and precise communication you’ll need in order to stay on time and on budget.

Consider everyone who will be relying on your timeline:

- Financing partners

- General contractor

- Real estate agents

- Vendors

- Business partners

Your timeline is the mouthpiece of your project. Everyone will refer to your project timeline to know if they are on schedule. They will refer to your project timeline to know when to expect the next phase to begin. They will refer to your project timeline to know how much time is available to work through obstacles.

If you finish ahead of schedule, that typically means greater profit. If you finish behind schedule, that typically means greater losses.

Reality TV makes it appear that a flip takes place in a week or two and even if they state the time that has passed, the nature of television still deceives the viewer of the true time.

Home Flipping Workshop goes beyond stating what should be in your business plan, in this case a timeline, and helps you answer questions about the nature of your project to establish a reasonable timeline.

Don’t rely on the timelines you see on TV or the timelines you’ve heard from other people. Build your business plan based upon the particulars of your deal and your location. That is the only way you can plan your profit with any type of accuracy.

More Time Costs Lowers Your Home Flip Profit

Poor planning can ruin your house-flipping deal before it even begins. Everything you see in the shows — cost overruns and missed deadlines — those are realities you are going to potentially run into. This is why you plan vigilantly ahead of time.

Plan against some of the most common profit suckers:

Underestimating the Cost of Renovations

Do not guess at expenses. Get hard numbers. Get real quotes. Maybe in the future your working knowledge of past deals can inform some mental estimates — but not right now. You need to deal in certainties.

Missing Deadlines

Remember above when we talked about deadlines being the communication everyone relies on? You must build margin into your deadlines and into the overall numbers. Nothing goes according to plan so plan on it costing more time than what you think. Add margin.

Overlooking Essential Details

Working with a coach, following a strict home flipping formula, or contracting professional consultants will hedge against this being an issue. If you go in solo you won’t know what you don’t know so count on missing key details and then having to pay for those errors.

Not Considering the Target Market

You need to know who buys in the area you’re flipping, what they’re looking for, what upgrades will render profits and what are overkill (killing your profit). Study the comps, decipher what is it about the highest comps that you could incorporate into your project that will render the highest return. Don’t build what you want… build what people are looking for (and can see themselves living in).

Failing to Budget for Contingencies

You know you need to do this. But we mention it because the flippers who have tried to do things on their own and inevitably come to Home Flipping Workshop… they thought they were doing this. There will be so many unexpected expenses but if you have a strong game plan on how you’re going to handle unexpected expenses… the expense will not longer be unexpected… you were prepared.

You’re going to have contracts, appraisals, inspections, negotiations and a whole litany of other time-consuming events in the process. Include all of this in your timeline so it works into your finances and doesn’t impact your profit.

Considering all the factors, you need a lot of energy to get through the project. To meet your timeline, falling behind is not an option in flipping property.

To avoid unwanted delays when flipping a house, consider the following seven steps:

- Plan: Create a detailed timeline of the entire project, including each task’s timeline, and allow plenty of time for unexpected issues to arise.

- Research local regulations: Familiarize yourself with local building codes, zoning laws, and permit requirements in advance.

- Hire reliable contractors: Work with experienced and dedicated contractors to ensure that the renovations are completed on time and with the desired quality.

- Be flexible: Be open to making changes to the plan as necessary and be prepared to adjust the timeline if unexpected issues arise.

- Stay organized: Maintain clear and detailed records of all expenses, deadlines, and progress updates to help keep the project on track.

- Keep the lines of communication open: Maintain open communication with all parties involved in the project, including contractors, real estate agents, and lenders, to ensure everyone is on the same page.

- Set realistic expectations: Be realistic about the timeline and costs involved in flipping a house, and be prepared to adjust the plan as needed to stay on track.

By taking these steps, you reduce the risk of unwanted delays and increase the chances of a successful and profitable house-flipping project.

Flipping A House With No Experience

If this is your first house flip, just because you don’t have experience doesn’t mean you can’t do it. You can ABSOLUTELY be successful and walk away with life changing sums of money.

Thinking you have to be a real estate expert to make money in real estate is an error in thinking.

Likewise, thinking you don’t need expertise or experience to flip and make a profit is unwise.

You most certainly need expertise and experience if you want to walk away with the most money possible.

So how can this be?

You don’t need experience but you do need expertise and experience? Which is it?

In real estate you can borrow someone else’s experience and expertise! That means you can examine what they’ve done, follow the path they’ve charted, avoid the mistakes they’ve made, follow the same pathway that’s led to success and sell your home for a huge profit.

The top players in any sport have coaches. Take Tiger Woods! If you watch Tiger’s swing today versus when he burst on the scene in 1996 you’ll notice there are differences. Not only in his swing but his approach to the game. Why? Because he changed coaches over the years to improve. The best players have coaches.

You want to be an A player and that means you’re going to look for a coach to help make that happen!

So far we’ve talked much about the finances, the timeline, steps to getting started, and the obstacles to be aware of. We haven’t even touched on the legal side of your home flipping deal.

Yes, legal should definitely be on your radar. You’re talking about borrowing money, employing contractors, buying real estate, and negotiating deals. What type of legal expertise do you need? Are there boilerplate agreements that exist which will hold up in court but don’t need to be drawn of from scratch? Is there a way to isolate my personal finances from the flipping arrangement? All good questions and all requiring answers you’ll need ahead of time.

In addition to legal side of the business you need to be thinking about the operations side of the business. Flipping homes is a gateway into real estate investing and if you want to build a successful real estate investment business you need to think about everything a business owner thinks about.

- Setting a Budget

- Getting Referrals

- Creating Your Team

- Setting Up Your Business

- Finding the Right Property

“But I just want to flip a home. I’m not really interested in building a business.”

This may be the case, but consider this.

First, the real money is not in flipping one home. The real money is flipping your second, third, fourth, and so on. If you’re going to put in all the work to learn the flipping business to quit after one home, well, that’s your prerogative, but what we have seen is that people get hooked and keep on.

Second, flipping and real estate in general is scalable. Meaning, if you feed it, it will grow. There is much that you’ll need to be involved in… but there is a A LOT that you can very easily hire someone else to do.

You can hire a business manager. You can hire an operations manager. You can hire an office manager. You can hire a bookkeeper. You can hire every position that you don’t enjoy and leave the positions and work you love the most for yourself. If you try and do everything yourself you will find that the parts that you really don’t enjoy doing will consume your time and steal your joy for real estate.

You don’t want this and we don’t want this for you.

You are going to become experienced in real estate really quickly. But not all experience is equal. In your early days, work with a coach, mentor, or consultant who can help you acquire the right experience. You’re going to spend the money on making mistakes or maximizing profit… it’s a lot less expensive to avoid the mistakes and focus on the profit.

What’s more, a good coach will not just walk you through what to do but they will actually educate you in the process so you won’t need them in the long term.

It’s True! No Experience Required In Home Flipping

What we have learned at Home Flipping Workshop over the last decade is that if you can flip two houses you have acquired the foundation for real estate investing success! Nearly every obstacle, negotiation, and challenge you overcome in flipping is a foreshadow of what you’ll need to be equipped to achieve success in real estate investment.

It really is the perfect gateway to financial freedom.

You don’t need experience, you just need to work with people who are experienced. That is, of course, if you’re looking for the top return on your flip.

This is no time for pride. This is the time for stepping back and saying to someone who has been where you’re going and achieved what you want to achieve, “Teach me.”

Experience provides several benefits, including:

- Improved skills and knowledge: Through experience, individuals learn from past actions and improve skills and understanding of a particular subject.

- Increased confidence: With experience comes a greater sense of confidence in one’s abilities.

- Better decision-making: Experience helps make informed and effective decisions by providing a more comprehensive range of perspectives and knowledge.

- New opportunities: Experience often leads to new and diverse professional and personal opportunities.

- Improved relationships: Experience can improve communication and interpersonal skills, leading to stronger relationships with others.

- Greater wisdom: With age and experience comes knowledge and a deeper understanding of the world.

On day one of your house flipping journey you’ll find yourself asking questions that you don’t know the answers to. Simple things like, “Is this a good property?” or “Is there something about this property that will cost a lot of money?”

Again, you’re looking to buy a home to turn around and sell for a profit. Yes, if you were going to hold on to the property long term you could afford to have a few unknowns come to the surface over time.

But not in a flip.

You need certainty. You need predictability.

While you don’t need experience, you need someone who is experienced to help you identify the money pit from the treasure in the field.

People who don’t get the proper training to prepare before flipping a house can face several challenges, including:

- Overpaying for a property: Lack of market knowledge results in overpaying for a property, reducing the profit margin.

- Underestimating renovation costs: Not accurately estimating the cost of renovations results in cost overruns which eat into the profit margin.

- Missing Deadlines: Failure to plan for potential delays results in missed deadlines, causes the project to drag on, and increases holding costs.

- Legal issues: Not understanding zoning laws, building codes, and permit requirements results in legal problems and fines.

- Poor quality work: Hiring inexperienced or unreliable contractors results in poor quality work that requires redoing, adding to the project’s cost and delaying the completion timeline.

- Inability to sell: Not understanding the target market results in a flip that fails to sell or sells for less than expected.

- Financial loss: Not properly budgeting for contingencies and unexpected expenses results in a project that becomes unprofitable.

These are just a few challenges people need to prepare for before flipping a house. Planning carefully and considering all aspects of the project is essential to ensure a successful outcome.

The Home Flipping Workshop has an incredible strategy that works for most deals and includes follow-up support for more complicated deals.

Starting any new journey causes you to learn more through self-education. To become an expert at flipping, start learning about the process, what you need, and what it takes.

With no experience, having a mentor to guide you in flipping properties is beneficial. Flipping is a relationship-based business; the better you are at it, the more money you can make.

Proceeding without experience can lead to poor decision-making, ineffectiveness, and preliminary results that produce no solutions.

Experience provides a foundation of knowledge, skills, and insight that help individuals make informed choices, understand the consequences of their actions, and adjust their strategies as needed.

Without experience, individuals are more likely to make mistakes, overlook important details, and struggle to achieve their goals.

How to Find A House to Flip

In the beginning, shopping for a house is fun and exciting! Over time it begins to wear on you. If you make an offer here or an offer there and don’t get the house it becomes frustrating.

House flipping and home buying shows will inspire you to get out there and get to work. But finding the right property typically proves to be a more ‘slow and steady’ affair.

You must find the right home. Not just any home will do. Buy the wrong home and you’ll wind up working months for very little payoff.

Here are some traits you want to consider. They will seem familiar, but truthfully, you’re buying a home that someone else will eventually want to buy. So of course some of the typical ‘real estate tropes’ will be true of your purpose.:

- Location: It significantly impacts value and desirability to potential buyers. Choosing a property in the most desirable neighborhood you can afford that has access to good schools, transportation, and amenities is essential.

- Condition: It impacts the work required to get it ready for sale. Properties that require extensive renovations may take longer to complete, resulting in higher costs.

- Profit potential: Choose a property that has the potential to generate a substantial profit after the completion of the renovations. Understanding the profit potential requires a thorough analysis of the market, the cost of renovations, and the estimated sales price.

- Cost: It must be in line with the budget and should not exceed the estimated sales price. Overpaying for a property can significantly reduce the profit potential.

- Competition: Consider the level of competition in the market and choose a property that can stand out from similar properties.

You need to develop a research and marketing analysis strategy. Whether you recruit a mentor or coach or decide to come up with your on strategy by trial and error, you need a framework to evaluate a home. You need to decide ahead of time what you are committed to buying before you start looking. This way you’ll be able to spot the winner from the losers.

This is something you do when looking for your own primary residence. It has to have a pool. It has to have a single story. It needs to be near a good school.

Why would you not set up these same parameters for your flip? You actually need more parameters because you will have limited money and limited time. Get this right.

Here are a few ways to find a property that will help you flip for a reasonable profit:

- Online Listings

- Realtor.Com

- Trulia

- Zillow

- Real Estate Professionals

- Wholesalers

- Mortgage Brokers

- Offline Searches

- Public Records

- Tax Records

- Court Records

- Networking

- Investment Groups

- Meetup

- Marketing/Advertising

- Social Media

- Online Advertising

- Digital Classifieds

- Auctions

- Auction.Com

- RealtyTrac

- HUD Homes

There is no substitute for diligently pursuing your perfect flipping property. The hungrier you are the better. The more diligent you are willing to be in your searching, the better. Everyone will see the homes that are easy to find. You need to figure out where the hidden gems are listed and how to get a look at them before everyone else.

A coach will help you leverage all avenues to your advantage so you have an edge over the competition.

Off-market deals (deals found outside of the traditional real-estate market typically through wholesalers or sellers who have not yet listed with an agent and are looking for quick sale) are often seen as the best because they provide several advantages over traditional real estate transactions:

- Less Competition: Off-market deals are private, so there is typically less competition for these properties, making it easier for buyers to negotiate better prices and terms.

- Faster Closing Times: Off-market deals are often quicker to close because there is less paperwork, fewer inspections, and fewer parties involved.

- Higher Profit Potential: Off-market deals can often be purchased for less than market value, providing investors with the potential for higher profits.

- Better Relationships with Sellers: Off-market transactions often result in better relationships with sellers, as the parties involved in the transaction are not competing with other buyers.

- Reduced Risks Deals: Off-market deals have a lower risk of falling through because there is less competition and fewer contingencies, such as financing and inspections.

- Ability to Customize Deals: Off-market deals often provide the opportunity to customize deals to meet specific needs and goals, such as financing terms and renovation plans.

Keep your eyes open and be aware. Finding the best deals in this market is vital to your success. If a property is on Zillow, it requires research and evaluation. But those are only some of the listings that will equip you for success. Remember, off-market deals are the most lucrative.

Separate yourself by finding those off-market deals known as “motivated sellers.” A motivated seller must sell because they want or need cash now. Look for the D’s:

- Desperation

- Death

- Disease

- Divorce

- Disgust

- Downsizing

The most significant D is desperation to sell. The Home Flipping Workshop will teach you how those sellers are not looking for top dollar, they want money quickly, and that is where you come in.

Off-market deals can provide several advantages over traditional real estate transactions, making them an attractive option for experienced investors looking to maximize profits and minimize risk.

Search listings for potential properties that are distressed and priced low – it’s the investment opportunity to look for when buying a property to flip.

Going through an agent or a broker makes your search faster because of their knowledge of properties that are priced low for flip deals, such as:

- Eviction Properties

- Distressed Properties

- Foreclosure Properties

- Mortgage Default Properties

A more promising method is by talking to a wholesaler. They find rehab properties, create a contract, and then find a buyer looking to flip that property. This is a win-win.

Auctions are another great way of finding a property to flip at a reasonable price, but they can be daunting. Paying with cash to offset any risks associated with an auction property is better.

There are so many more options to utilize to help you find a property to flip:

- Short Sales

- REO Listing

- Direct to Seller

- Digital Classifieds

- MLS Database

- Investment Groups

The goal of a real estate investor is to find a low-priced property. The secret is in the investor’s ability to find a ‘diamond in the rough’ and fix, flip, and sell it for a profit.

Focus On Building Your Flipping Blueprint

Much of what we’ve covered is very straightforward and, in some sense, almost no-brainer information.

But it’s essential.

You can’t skip steps. You can take shortcuts (at least not in the beginning). You cannot afford to make a mistake — you’re trying to build something profitable.

As much as this process is a business development and real estate exercise it is also a personal development exercise, too.

Your preparedness as a leader and high capacity individual will play a big role in whether or not you get the biggest return on your investment.

If you embrace that this is a character building exercise as much as anything you’ll find yourself developing core strengths that will not only help you in real estate, but bring fulfillment in life overall.

Here are some character traits we challenge Home Flipping Workshop students to embrace.

- Avoid distractions: Laser-focused individuals effectively avoid distractions and maintain productivity by dedicating their attention to the task.

- Prioritize effectively: Laser-focused individuals prioritize their efforts and ensure the completion of the most critical tasks by focusing on one step at a time.

- Make more progress: By devoting their total energy and concentration to a single task, laser-focused individuals make significant progress in less time, leading to quicker project completion.

- Stay motivated: Concentrating on a single goal at a time helps individuals stay motivated as they witness their progress and results.

- Eliminate unnecessary activities: Laser-focused individuals efficiently eliminate time-wasting activities that do not contribute to their ultimate goal.

What is the difference between people who are at the top of their game and everyone else?

Laser-like focus in a single direction.

There is something powerful about being so focused on a very narrow scope of work. It not only blocks out the distraction of multi-tasking, you also elevate your ability to lead in a specific area.

You are capable of so much greatness! Maybe you’ve never really thought about yourself as a leader or someone who is capable of greatness. But you are!

Lasering in on your home flipping property could be the very think you need to replace generalist output for something sharp and powerful.

Contactors, real estate agents, financial advisors, investors, and many others will be looking to you for leadership, communication, and motivation. Becoming laser-focused on buying the right property and flipping it for maximum profit will be a vibe that rubs off on everyone involved and as a result, you’ll get their best output.

How to Flip A House with $10,000

While it is true that you want to use other people’s money as much as possible to fund your deals, you do need to have some cash available to get into the flipping game.

A great number to aim for is $10,000.

While you can’t purchase a property outright with $10,000, you can actually do a lot more than you think. You can make it work in your real estate play in other ways.

- Use for a Down Payment

- Invest in an Airbnb

- Become an Investing Partner

- Become a Real Estate Wholesaler

- Get into Real Estate Crowdfunding

These methods could make $10,000 go a long way and quickly turn it into a recurring cash flow.

Glenn and Amber Schworm have put together multiple plays that you could make with $10,000. Even when funds are limited, options still exist. Tapping into the experience, expertise, and relationships of other people is your secret weapon no matter how much money you have. It just so happens that if you’re short on money you can use those three items to make up a huge amount of the difference. You gain:

- Access to resources: Many available resources help you achieve your dreams, even with little money. There are many ways to gain the knowledge and skills you need to succeed, from online courses to free workshops and events.

- Creative solutions: Limited funds can often lead to creative solutions and innovative thinking. By working within a tight budget, you may find new and better ways to achieve your goals that you wouldn’t have discovered otherwise.

- Opportunities to network: Pursuing your dreams provides opportunities to network with others with similar interests and goals. These connections provide valuable support, guidance, and resources.

- Personal growth: Pursuing your dreams helps you grow and develop new skills, knowledge, and confidence.

- Fulfillment: Achieving your dreams brings a sense of pride and satisfaction that does not compare to material possessions or financial success alone.

Limited funds should not be a barrier to pursuing your dreams. With determination, creativity, and the right resources, anyone can achieve their goals, regardless of their financial situation.

Property flipping is a lucrative business, and having the finances to get in on the ground floor is not all about having cash.

Money Is Not An Obstacle

We’ve said it multiple times, but money should not be an obstacle. Don’t let money stop you from flipping a home. Yes, you’ll need to get creative, but creativity can win the day!

Experienced investors know that creativity overcomes a myriad of obstacles and there are many mechanisms that exist to help hungry and motivated entrepreneurs and investors get into the game no matter their net worth.

Some of the strategies that Home Flipping Workshop students leverage as a part of their business plan include:

- Partner with others: Joining forces with other investors or business partners can provide access to additional resources and help spread the risk.

- Be creative with financing: Experienced investors are often creative with financing, finding alternative sources of funding that may not be available to others, including crowdfunding, peer-to-peer lending, and using retirement funds.

- Build a network: Experienced investors often have a network of professionals, such as lawyers, accountants, and real estate agents, who can provide support and guidance.

- Utilize government programs: Experienced investors know government programs that provide financial assistance and incentives, such as grants and tax credits.

Experienced investors understand that money is just a minor obstacle to achieving their goals, and they have developed creative strategies to eliminate it as a barrier. These strategies allow investors to access the resources they need to succeed, even with limited funds.

Using other people’s money is a quick way to fund your property flipping deals, but you need to know whose money to use. It’s best if you have options.

The following nine options are the primary ways investors secure funds:

- Live-in Flip

- Wholesaling

- Home Equity

- Option to Buy

- Crowdfunding

- Private Lenders

- Seller Financing

- Hard Money Lenders

- Partner with an Investor

Many new investors need to be made aware of the funding opportunities available to them.

It does not matter whether you are a new or a seasoned investor, utilizing the above factors is the best real estate strategy to get you started with no money in the market today.

Discover the Key to Flipping Houses

Perhaps you’ve always known you don’t want to fly blindly into your home flipping experience.

Maybe you’ve skimmed through our plan article and decided that it would be worth exploring an educational experience like Home Flipping Workshop.

Regardless of how you arrived at the decision to pay for training (versus paying for mistakes), you should be applauded. Home Flipping Workshop isn’t for everyone but the people who do go through it and commit to their home flipping dreams find that the key is following a proven plan.

In three days students learn the entire scope of home flipping success and take the principles covered in this article and actually are able to fill in many of the blanks with their only business plans.

Imagine having a bulletproof method to invest in real estate without experience, money, or credit.

Glenn and Amber Schworm turned $80K of credit card debt into over $100 million in business earnings, and have crafted a formula for securing your economic freedom.

Join our intensive 3-day virtual Home Flipping Workshop where you’ll receive no-nonsense training that reveals:

- Insider secrets about wholesaling

- Long-term strategies for real estate investing through property ownership

- Techniques for building generational wealth by fixing and flipping houses

Seize this opportunity to fast-track your journey towards financial and time freedom. Thousands of ordinary people earn $40-100K per deal by flipping houses, and many do it using other people’s money.

With over 1,000 successfully flipped houses since 2007, Glenn and Amber Schworm are offering you their proven system on a silver platter.

At the Home Flipping Workshop, you will learn how to:

- Find lucrative properties in your local area

- Secure funding without relying on your own money or credit

- Confidently add value to deals through skillful renovations

- Utilize our foolproof formula to flip houses and generate substantial profits

- Capitalize on opportunities for recurring revenue by holding properties

Glenn emphasizes, “Our Home Flipping Workshop teaches you how to make money through buying and selling properties and accumulate wealth through homeownership.” It is the key to flipping houses.

Real estate investing is not a one-size-fits-all endeavor. Glenn and Amber provide mentors and coaches to support students upon completing the course.

Our workshop also addresses common fears and provides professional development for aspiring entrepreneurs.

Attending the Home Flipping Workshop gives you a clearer vision of achieving overall success.

Use the Home Flipping Workshop content to learn proven techniques and gain valuable tips.

What is your dream for your life?

We often hear about living the dream, but how many achieve it? Don’t underestimate the power of your dreams. Instead of merely observing wealthy individuals driving fancy cars, living luxuriously, and traveling at will, strive to attain your personal dreams.

While celebrities earn significant amounts of money, they often require guidance to find their purpose. The Schworms share bulletproof strategies, based on their extensive experience in the real estate industry to help individuals make their dreams come true.

With VestorPro, you can access a wealth of knowledge and expertise to guide you through the intricacies of real estate investing.

Contact VestorPro today to get started on your journey toward success. Their team of professionals is dedicated to providing personalized guidance and support tailored to your specific goals and aspirations.

By reaching out to VestorPro, you can access a treasure trove of real estate blueprints that will serve as your roadmap to financial prosperity.

Don’t let uncertainty hold you back from achieving your dreams in the real estate industry. Take action now and contact VestorPro today. Their proven strategies and passion for empowering individuals make them the ideal partner on your path to success.

Embrace the opportunity to learn from industry experts and turn your aspirations into reality with VestorPro’s real estate blueprints. Get in touch with them today and embark on a journey that will transform your life.